Some notes on Real Money Gaming (RMG) in India

The gaming industry in India has been growing exponentially in recent years, with many people joining the ranks of avid and serious players. India has now become one of the leading countries in the world in terms of gaming, and this is largely due to the large population, the availability of technology, and the increasing enthusiasm and accessibility of gaming platforms. With more and more people playing games, India has become a massive and vibrant gaming community, with people of all ages and backgrounds enjoying the many styles and genres of gaming. From console and PC gaming, to mobile and online gaming, there is something for everyone to enjoy in India’s gaming scene. This post mostly focusses on the real money gaming market, potential profit pool and if somebody is starting a RMG company in India - this document can serve as a preliminary primer in understanding the market.

High level Index:

- Why bother building in India in the first place?

- What is the current market scenario in India?

- How is the entire gaming industry revenue split?

- Where is majority of the revenue and profit potential?

- Which sub vertical is growing?

- What are users majorly playing?

- Where is the market opportunity?

- Differentiator for RMG companies starting today and path forward for building a RMG business

1. Why India?

Bull case for gaming in India

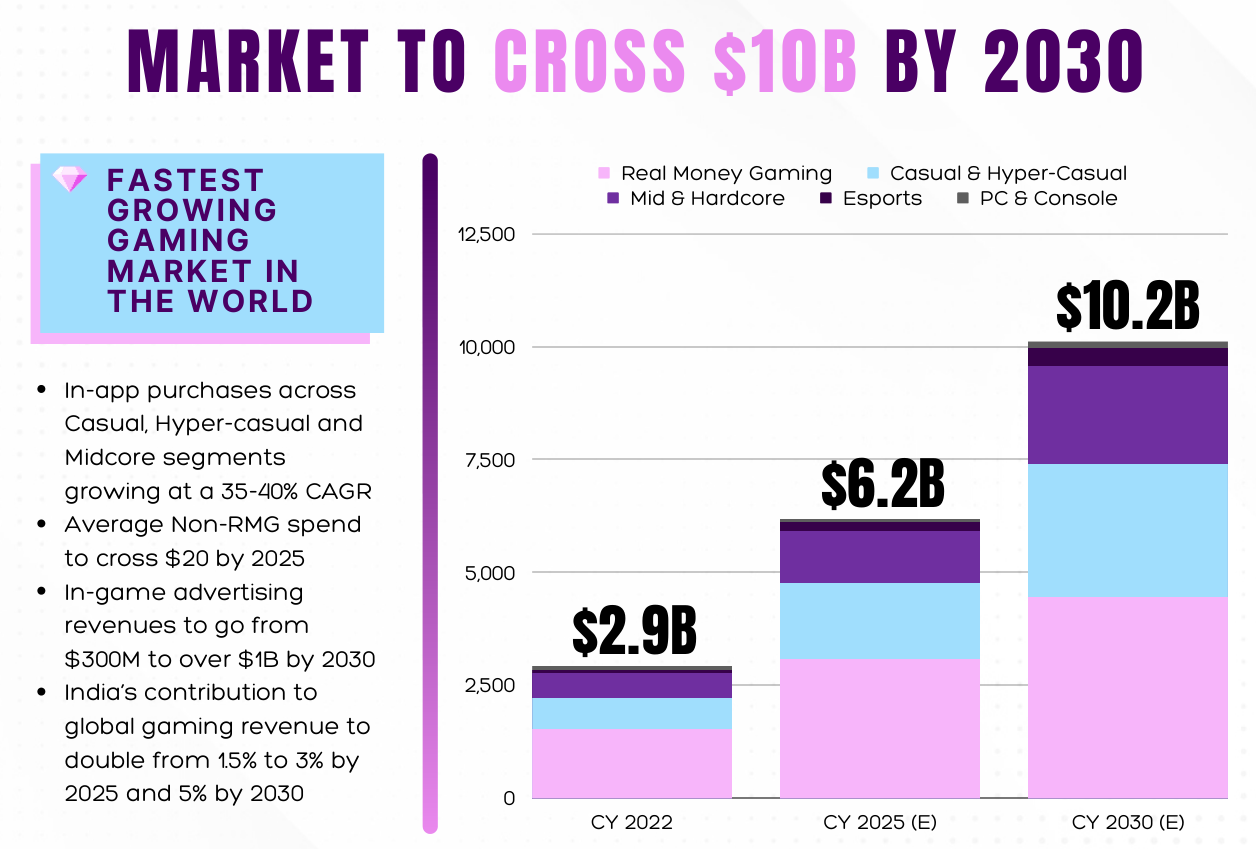

- About $3Bn market size but having consistent growth. RMG dominates about 55% of this

- Cheap data/ digital payment penetration

- 90% users play on a mobile phone and entry level smartphones are some of the cheapest in the world

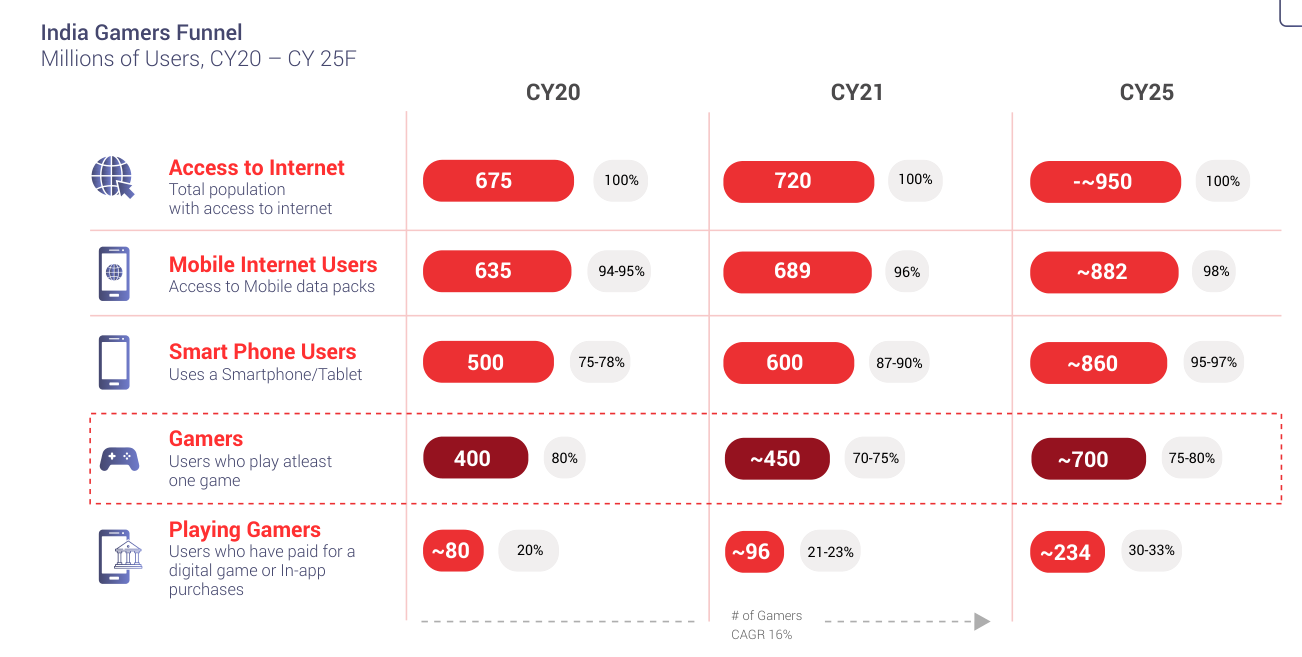

- Growing youth population. Already the youngest population which overlaps greatly with the target demographic for gaming. About 400Mn gamers today is the conservative estimate

- This photo illustrate the growing internet user base leading to growing number of gamers » growing number of paid gamers

- Among this - about 110Mn are paying gamers which includes RMG + IAP + subscriptions.

- This number is set to double along with ARPU according to Redseer (by basically benchmarking with US/China)

- 90% of them are mobile based. 90% revenue also comes in mobile.

Demand side plus points

- Affinitly/Aspiration to make money/win money online is high for our demographic. Aspirational youth population.

- Rising disposable income. Lot of this 400Mn gamers are in Tier 1-2 cities

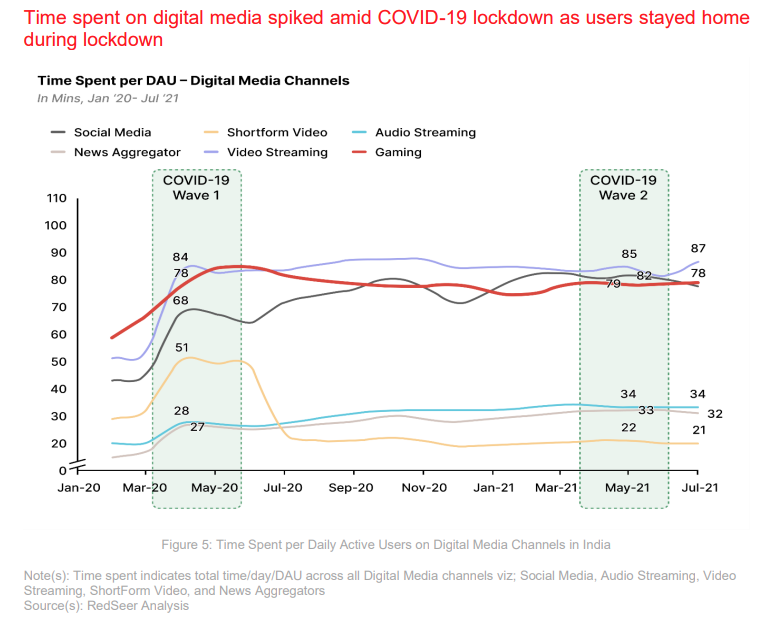

- Time spent in gaming rivals OTT/Social. About 3.1hrs per week

- Power user retention and LTV is comparable to international platforms. Example: 20% of MAU of Adda52 are players who are > 3 years old on the platform.

Supply side

- Rich cultural history leading to lot of familiar homegrown titles. Rummy is about 85% of the RMG market which in turn is about 55% of the overall gaming market

- Multi gaming platforms (MGP’s) still haven’t exactly cracked the unit economics for hyper casual games but they at least bring in DAU

- Rising consumer trust in online platforms and digital payments

Bull case for building outside India?

- ARPU is much higher outside India. While you can argue that the core power user ARPU is comparable, the number of them playing these games for a living/seriously is very little. Check out this post for more about this set of these power users in India

- Conversion % for casual is ridiculously low in India. About 60% of non-RMG is ad supported

- Regulation for a lot of real money games is unclear. SRO’s (self regulatory organizations) still haven’t been formed and states banning betting overnight is an existential risk.

- Multi gaming platforms haven’t solved for retention thereby leading to unsustainable unit economics for most games (churn is especially higher for the hyper casual real money games).It is still a problem plaguing the industry

- Certain companies have advertising monopolies. Acquisition is expensive compared to the LTV that 80% of the customers offer

- Changing perspective about skill games and their money making potential. People no longer view them as gambling but rather as legitimate career options. Money making potential for certain games like poker in Indian rivals an executive salary at FAANG.

2. Indian Gaming Market

Revenue Split

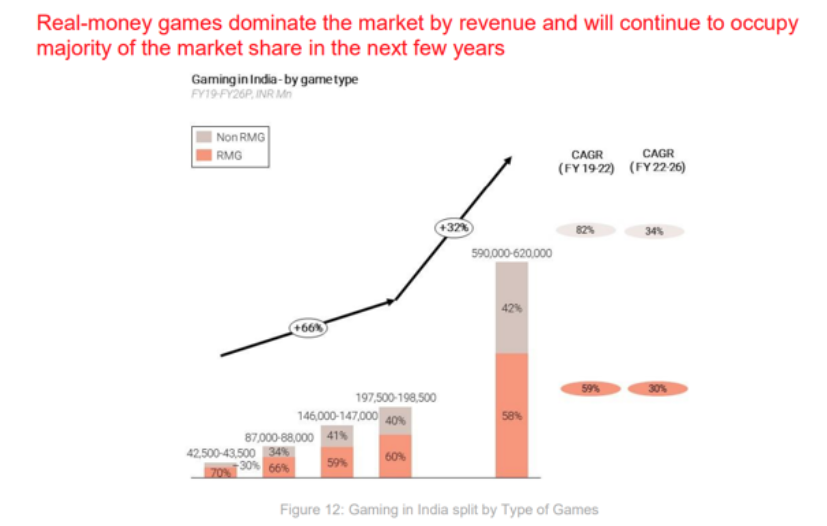

RMG dominates the market account for about 55-60% of the overall revenue. While casual games attract the largest number of users and have been crucial in growing the mobile gaming culture in India, while real money gaming attracts the highest paying users in mobile gaming. As a result, real money games have been the largest revenue source for India’s gaming sector. This segment is expected to grow at 30% CAGR with growing expectation of regulatory clarity.

RMG vs Non-RMG

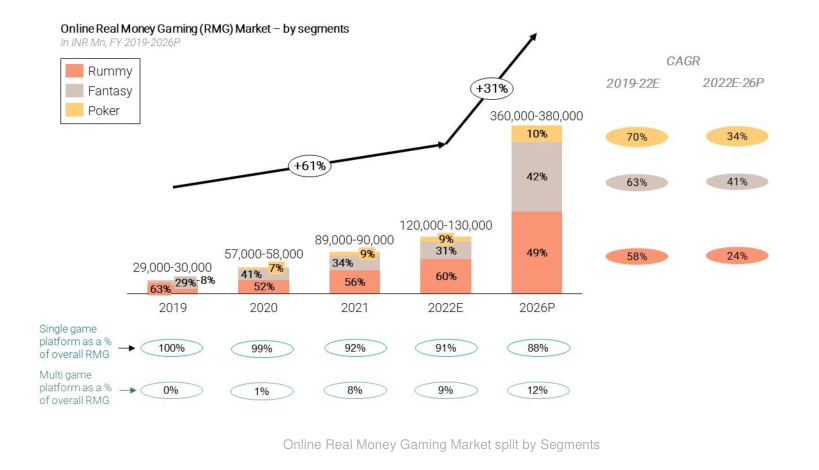

Online RMG market is segmented into 3 game types (Online Rummy, Poker & Fantasy Sports) and by platforms into Single game (>91%) & Multi game (~9%) - collectively growing at a CAGR of ~61% for the last 3 years. Online Real Money Gaming Market split by the following segments :

Rummy is currently the largest segment and is expected to dominate the RMG market in the future due to rising number of new rummy users from north India and increasing propensity to pay of existing users. Rummy market is expected to increase from $1Bn in FY2022 to $2.4Bn-$2.5Bn in FY2026 at CAGR of 24%.

Poker has the least penetration when compared to rummy and fantasy, indicating a very high potential for growth in the coming years. Poker has the highest user retention rate and highest revenue per user among the two games considered here. Poker market is expected to grow from $150Mn in FY2022 to $450Mn in FY2026.

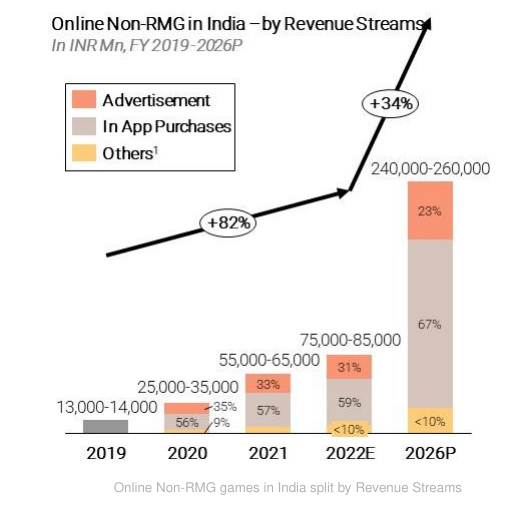

Inside Non-RMG, where is the money coming from?

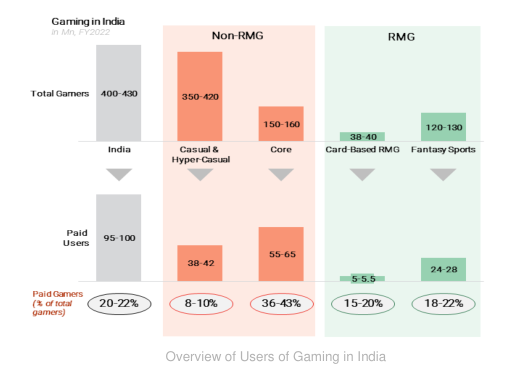

Lets now move on how the users are split between RMG vs Non-RMG. The Non-RMG market has two major categories in terms of game types - Casual and Hyper-casual, and core games. Casual and Hyper casual games offer a quick and easy means to pass time and have become a popular entry point for India’s first-time mobile gamers. As a result, this segment has the highest number of overall users, i.e. 350-420 Mn, with very low paid user conversion rate (8-10%). Also, there are around 150-160 Mn core game users with very high conversion of paid gamers (36-43%)

RMG witnesses a MACU of 12-13 Mn of the total 26-30 Mn real money gamers and it is expected to reach 60- 80 Mn real money gamers in the upcoming years.

Everything else like e-sports, desktop, platforms are rounding off errors at the moment. E-sports grew about 5x on a small base but has plateaued since.

Multi Gaming vs Single Gaming platforms

While Single Game Platforms (SGP) currently dominate the market with (~90%) market share; the upcoming format of Multi-game platforms (MGP) may get popular in the future. MGPs offer a wider variety of games to users; and are therefore able to attract gamers from a wider set of interests and abilities. It should conceptually also be able retain them more by keeping them entertained and engaged for a longer time due to the wide array of game offerings (in reality however, this is harder than it looks).

The recent rise of MGP can be attributed to greater game types attracting wider variety of audiences(thereby increasing reach), distributed game dev costs and ability to capitalize on cross game synergies. In its current state, MGP is growing at ~40%; which is the highest across various segments of RMG; and is expected to be ~12% of the market by 2026. While, the relative share appears low, in absolute terms this translates to nearly $500Mn (viz. ~4x in 5 years) by 2026. This explains the observed interest amongst gaming companies to explore and grow as Multi-gaming Platforms.

MGP’s have also really lowered customer acquisition costs by spreading it and averaging it between low CAC games like Fantasy/Ludo and high LTV games like Poker/Rummy etc. However, not all things with MGP’s are positive. Majority of the users still go to these app to play 1-2 games and don’t deviate beyond them. Habit forming for the rest of the games is still a hit or miss.

3. Some perspective on RMG/gaming and way forward

How are these RMG businesses differentiated?

RMG has more or less become a commodity business. Most products look the same and some companies even modify their GTM to match competitors in hopes of attracting users with a familiar platform and better deposit offers(like a vampire attack). Product innovation has been slow or non-existent in this industry for the last ten years. Adda52 from 2013 looks 90% same as today. Moreover, given the extremely low M12 retention rates, you have to keep acquiring users (spending money) every year as your platform churns through them - making this a treadmill business.

Core problems to solve for in RMG:

- LTV/CAC doesn’t work

- High acquisition costs but low average LTV. For example: CAC for acquiring poker players is about Rs. 15k and its impossible to make this money back if 75% of your new users churn out before 3 months. This problem has to be solved from both ends by lower acquisition costs and improving retention

- Possible solution: Mini game casual variants of popular card games with shorter game loops would set the product apart in terms of giving new users a feel and taste of the game related wagering/betting while at the same time without diluting the skill aspect.

- Timepass.Games is doing this for hyper casual games in a TikTok variant. Idea is to engage the user for longer by giving them multiple games in quick shorter formats

- There are some caveats to making RMG games in shorter formats. As a rule of thumb in RMG businesses, 80% of your revenue comes from 15% of your users. This ratio is extreme for some games like poker and normalized for bigger games like Fantasy. If you reduce the game loop duration, its very hard to have the same ARPU as earlier and retention is still an open problem with hyper casual variants. Having tight game loops along with strong product driven conversion milestones to make the user play the longer variant could alleviate some of these concerns.

Poor retention

In my own experience, the single biggest factor determining the retention of a player is their loss rate(money lost /day). If a player loses money on the platform, he/she is prone to churn. This is unfortunately unstoppable in the RMG business because of its design. However, we can explore couple solutions:

- Make losing money for new players slower and more enjoyable. At the end of the day, 95% of your players are going to lose money. Giving them a fun and interactive experience lowers chances of churn. Kickass FTUE teaching the players to make sure they learn the rules before wagering is key as well.

- Re-acquiring them again using a network site model. This is an under explored concept in India where multiple website skins could share liquidity of players. This way, you can have a gamified skin of the game marketed towards one target group and serious/pro friendly version marketed towards a different set of users. They can share player liquidity across all games while still having different fee/reward structures. Taj Rummy/Poker is doing this to some extent with a very bad product at the moment in India but there are no big name players yet. Gameskraft has brilliantly marketed 4 different Rummy versions which all share liquidity to keep re-acquiring their churned out users for cheap.

At the end of the day, majority of your revenue comes from power users who choose your platform primarily for player liquidity and product experience. Recreational users are attracted towards big offers and guarantees but churn out when they lose. Ensuring you can retain/re-acquire recreational users through strong data driven offers/loops and providing superior gaming experience to power users would lead to a sustainable RMG business in my opinion. However, having a great product by itself is not enough. Distribution is super critical and making sure you can acquire users for cheap makes or breaks a platform. Cross game analytics/anti fraud/rewards (which is by large forgotten by most companies) is paramount to predict and minimize churn.

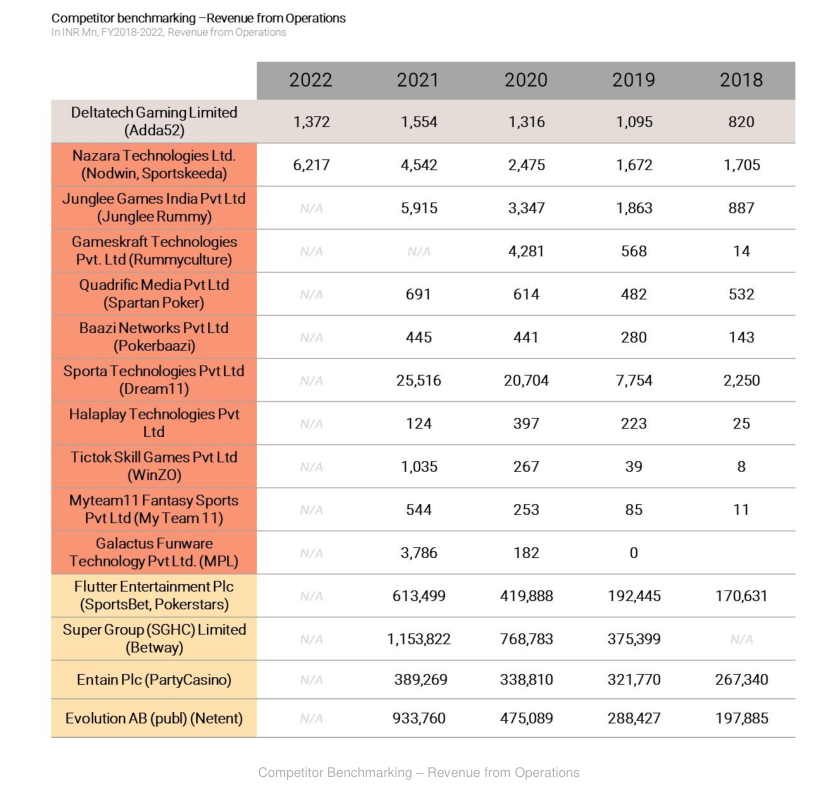

Revenue comparison between some Indian and foreign betting companies shows the market potential for a mature player globally:

Sources

- Delta Tech(Adda52) DRHP

- Nazara gaming DRHP

- Redseer, BCG and Newzoo research reports

- Lumikai and Konvoy VC blogs

If you liked this, checkout my other related posts too: